Succession planning, the process of developing talent to replace transitioning executive and leadership roles, is part of a successful business plan and ensures business continuity. Owners who are looking to retire, exit the business, or hoping to pursue a new endeavor should also have their own exit strategy to transfer ownership of the company to another person, team, or entity.

A strategic plan for succession and an exit strategy begins well in advance of an owner’s exit, encompassing business valuation, negotiation, funding arrangements, successor designation, and time to review and adapt the plan as new situations arise.

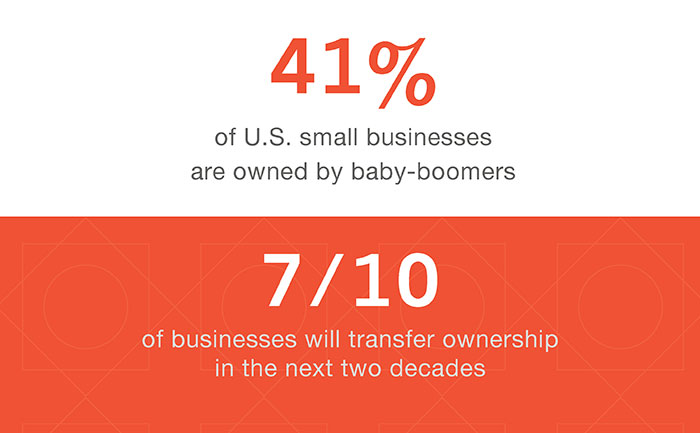

Currently, about fifty percent of U.S. companies are owned by Baby-Boomers who are looking to retire in the next coming years and it’s expected that in the next two decades, seven out of ten businesses will transfer ownership. Creating a successful succession plan or exit strategy can prepare your business for the journey ahead.

How can ownership be transferred?

Ownership of your business can be transferred to an individual(s) from within your company, or an organization/individual(s) from outside your business. Upholding the vision you created at your business, your successor could be anyone from family members or employees to a strategic or financial buyer.

Transferring ownership to individuals or organizations outside your business can be accomplished through:

- Private Equity, which transfers ownership to a group of investors, creating a liquidity event for the current owner(s) while simultaneously providing expertise for the future of the business

- Initial Public Offering (IPO) by offering shares of your private business to the general public in a new stock issuance

- Or, a strategic buyer, which transfers complete ownership to an individual outside of your company, a competitor, an organization within the same supply chain, etc., opening new opportunities to create a more powerful entity and enter new markets

Transferring ownership to individuals within your business can be accomplished through:

- A management buy-out, which allows your company’s management team to purchase the business they manage and are deeply familiar with

- A complete ownership transfer by the gifting of shares or sale of your company to a family member or business partner

- An Employee Stock Ownership Plan (ESOP) gives stock ownership to employees through the establishment of a trust. This ownership structure connects you company's employees to the long-term success of the business and allows for the possibility of the transitioning owner to remain involved in a leadership role

What should I consider prior to selling my business?

Have the right partnerships in place. Regularly discuss and evaluate your succession plan and exit strategy with your attorneys, accountants, and bankers. The sale of your business, regardless of approach, must be well documented for tax implications and bank covenants. In addition, an experienced investment banker or business broker can also help facilitate the sale of your company, offering inside knowledge to potential buyers.

Future cash flow. In advance of executing an exit strategy, cash flow needs to be considered for both the exiting owner and the buyer's needs. Depending on how your business is sold, owners may have an outstanding seller note for several years. Aligning your company’s future capital requirements as well as your own with its current profitability can ensure a sustainable exit strategy.

Market value. Business valuations by an experienced professional can inform your decision to sell and prepare you for opportunities when market forces are most favorable. Keep in mind, there are multiple approaches to valuing a business, so a final purchase price will most often require negotiation.

Be prepared for the journey ahead.

As market conditions change and developments to your business are made, it’s important to revisit and reevaluate your exit strategy or succession plan. Updating and making timely adjustments or alterations to your exit strategy or succession plan can help ensure terms that are most favorable for all parties.

Whether you decide to transfer ownership within your company or outside, planning for the future of your business after your exit can prepare your organization for the road ahead. Setting up long-term company success through succession planning and exit strategies will help your business achieve critical outcomes well beyond your tenure.

About the author

Dan Bender is the Senior Vice President, Commercial Lending Team Leader at Westfield Bank, providing expertise in establishing credit facilities for working capital, capital expenditures, business acquisitions, and real estate purchases and refinancing. Dan is based in our Brecksville office and is helping to establish the ESOP lending program at the bank.

Article resources

Guidant Financial (2020). Boomers in Business – 2020 Trends A look at baby boomer-owned businesses in 2020. Retrieved 2020, from https://www.guidantfinancial.com/small-business-trends/baby-boomer-business-trends/.

California Association of Business Brokers (2020). Baby Boomers: Incredible Numbers are Buying and Selling Businesses. Retrieved 2020, from https://cabb.org/news/baby-boomers-incredible-numbers-are-buying-and-selling-businesses-part-1-2#:~:text=These%20assets%20are%20held%20in,businesses%20that%20will%20be%20sold.