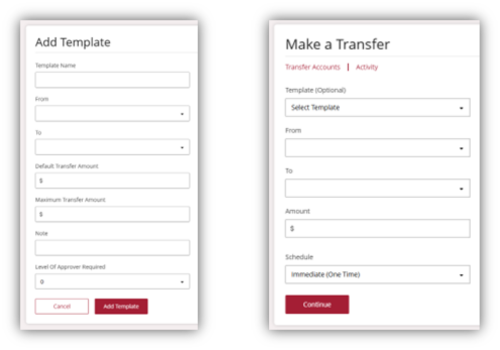

Business transfer templates

The new business transfer template feature allows you to create, manage, and use transfer templates for efficient money movement. You will now have the option of making transfers by either selecting a template or by manually selecting the transfer from and transfer to accounts. Adding a template can be done under the Transfers dropdown in the menu bar. Flexibility has been built into the amount field to allow for a range in the dollar amount (minimum/maximum limit).

Wire Enhancements

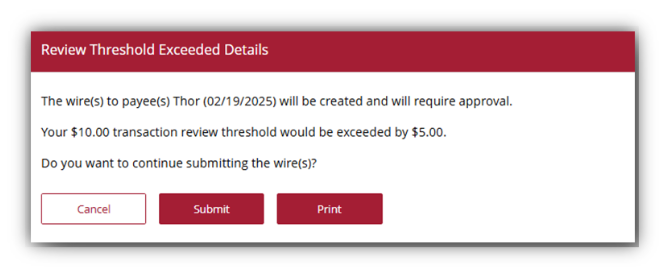

- Current Maximum Limits have been renamed to Maximum Threshold Review and new Hard Limits have been introduced

- New FI Review Threshold Override Approval entitlement to allow Westfield Bank to require wire files to be reviewed and approved prior to processing.

- New pop-up indicating that a submitted wire needs review when FI Review Threshold Approval is set

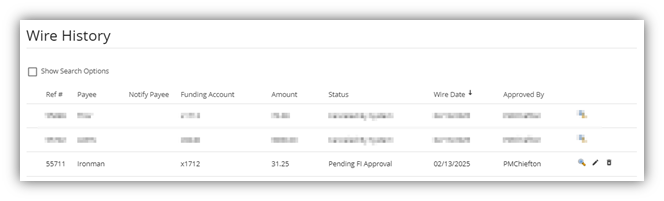

- New respective status of Pending FI Review has been added under Wire History

Wire Search

We have enhanced the account activity page to filter for wire activity. Prior to this release, you could not specifically search for a wire. Now you can search for the specific transaction type of “Wire Transfer” and see any associated activity.

ACH Enhancements

Transaction type updates

We have improved the user experience when creating an ACH batch/template to make it more intuitive. When creating an ACH back you’ll need to:

- Select the Transaction Type you wish to initiate (Payment [sending] or Collection [receiving]).

- Once the Transaction Type is selected, the SEC Code list will dynamically update to display the available options, providing a simplified and streamlined process for selecting the appropriate SEC Code.

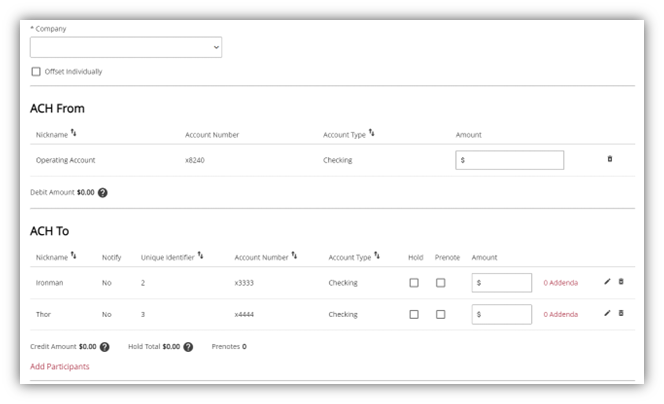

Interface enhancements

You’ll see a new interface when creating ACH batches/templates. The interface includes:

- ACH From and ACH To sections, which dynamically display based on the selected transaction type.

- Adding an account has been simplified; you can now click a button in the respective ACH From or ACH To section to add an account. To select the offset account, users need to click Add Account in the offset account section.

- The Add Participant feature has been updated to dynamically display in the correct section based on the transaction type.

- New fields for Debit and Credit amounts are now available in each section, along with Hold and Prenotes.

Limit Enhancements

We have added new ACH Hard Limit and Override Approval entitlements. The hard limits are dollar amounts that prevent an ACH Batch from initiating. You will immediately receive an on-screen notice that the batch is above your defined hard limit amount. The override approvals will be a Westfield Bank level and a business level entitlement. These allow approvals for when a batch is over the review limit but under the hard limit.

There has also been a naming convention change. We have renamed the current Maximum Limits to Review Thresholds.

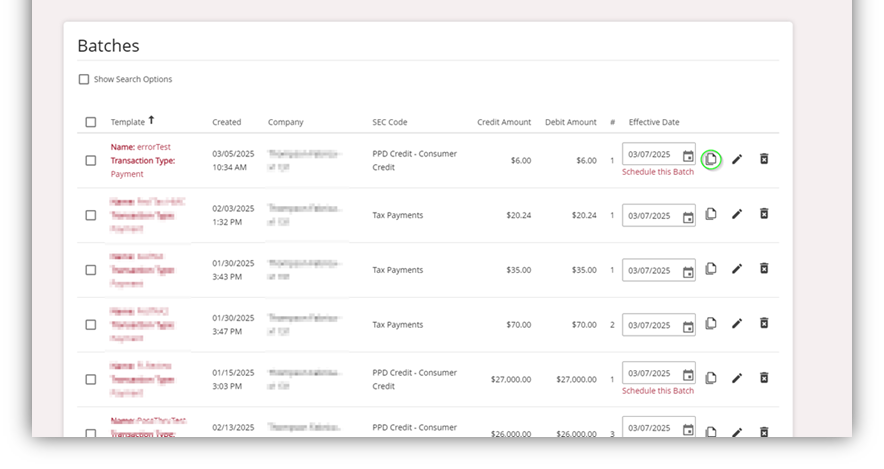

Copying existing ACH templates

We have added a new copy icon and feature to the ACH template screen. You can now copy existing templates carrying over all details of the existing template (excluding template name) and can edit or save the details as required.

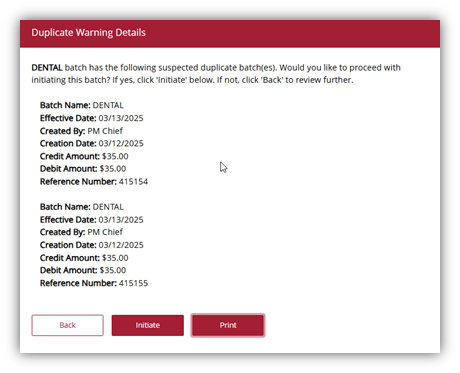

Duplicate check

To help reduce the submission of duplicate batches, a warning message will now pop-up when there is a duplicate batch detected when using the One-Time ACH, ACH template, or the ACH Pass-Thru pages. The warning message contains information of the earlier initiated batches. If more than one batch is initiated, then a list of up to ten previous batches is visible on the duplicate warning message.

Security and fraud mitigation

Westfield Bank administrators now have the option to terminate an active session and secure a compromised account. In a scenario where a fraudulent user exists or potentially exists an administrator can select to terminate a session. That user will be logged out of their current session on the next page load/navigation and cannot log in again until Westfield Bank’s set timeout session has expired. During this time, we will go through our standard fraud mitigation procedures.

If you have any questions, please feel free to reach out to your relationship manager or our Customer Resource Center at 800.368.8930.