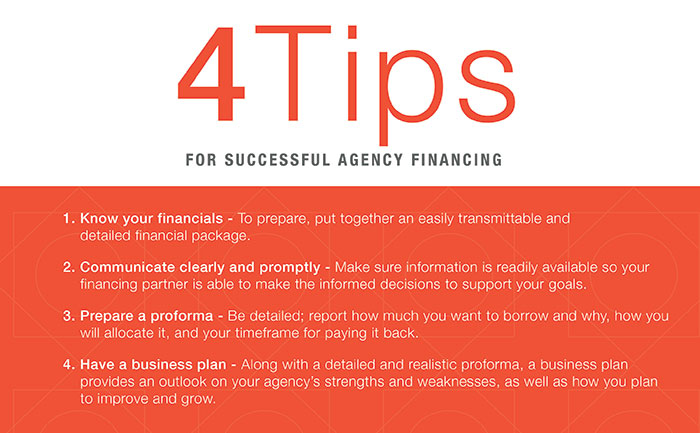

Agency financing: tips for success

Agency financing can provide you with capital to start or expand your business. Acquiring this financing requires a lot of forethought and planning, however Westfield Bank is here to make the process smooth and successful. Here are some tips to help you prepare for your meeting with your lender.

Know your financials

One of the most important things your lender will consult in their process is your agency’s finances. Knowing your numbers, being able to tell your company’s story, and having a detailed financial package to back it up will be your advantage.

To prepare, put together an easily transmittable and detailed financial package. To make the process as efficient as possible, make sure what you tell your lender matches what is in the financial package. Doing your due diligence by delivering accurate financials will go a long way in creating confidence for your lender and nurturing a mutually beneficial banking relationship.

Communication

At Westfield Bank, we form true partnerships, understand your unique business, and collaborate with you to customize a financial solution to achieve your goals. Make sure information is readily available so your financing partner is able to make the informed decisions to support your goals. Be sure to provide documentation and updates in a timely manner. As with any relationship, an open and direct line of communication is important—if something changes in your business, we can provide insight and tools to help.

Prepare a proforma

A proforma is a projection of what your agency’s financials would look like after you’ve completed your acquisition, capital improvements, or purchased a book of business. Use the proforma to tell the story of how this money will help your agency reach its goals. Be detailed; report how much you want to borrow and why, how you will allocate it, and your timeframe for paying it back. Make sure your proforma is realistic. As your banking partner, we are dedicated to your success and will make decisions based on your proforma and continue to track your progress.

Have a business plan

Along with a detailed and realistic proforma, a business plan provides an outlook on your agency’s strengths and weaknesses, as well as how you plan to improve and grow.

Acquiring agency financing is as much about character and trustworthiness as it is about financing and business plans. At Westfield Bank, we aim to form relationships with each of our customers. Forging this relationship will help you reach new heights.