Is consolidating your student loans right for you?

Many borrowers can attest that student loan payments make up one of the most burdensome portions of their monthly budget. If you have outstanding student loans, you may be looking for options to ease this burden. One option that student loan borrowers can turn to is consolidation, which is the combination of multiple loans into one.

Depending on the type of loans you have, there are two main types of consolidation – federal and private. If you have multiple federal loans, you have the option to combine your loans into a Federal Direct Loan Consolidation. If you have private student loans (or a combination of federal and private), you have the option to combine your loans into one private consolidation loan (also known as student loan refinancing) by working with a bank or private lender.

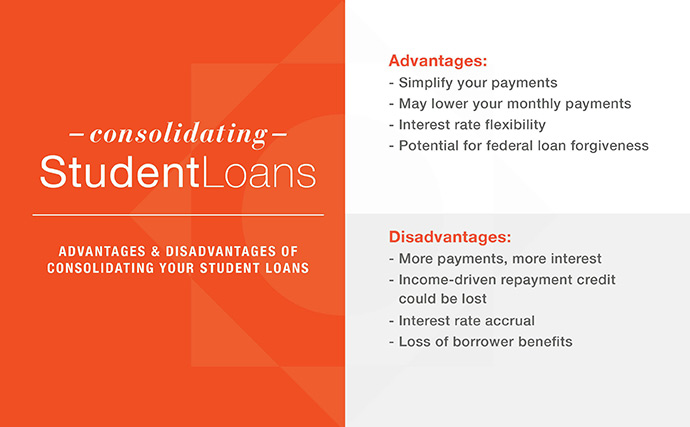

Consolidation makes sense for some borrowers, but not for all. If you’re considering this option, be sure to consider the advantages and disadvantages of consolidating your federal student loans.

Advantages of consolidating your student loans

- Simplify your payments - if you have loans from multiple lenders, consolidating them into one loan will likely make your payment process much easier as you will only have to pay one monthly bill

- Lower your monthly payments – when borrowers consolidate their loans, it often results in a lower monthly payment, as consolidation leads to a longer period of repayment

- Interest rate flexibility – consolidation gives borrowers the ability to switch variable rate loans to a fixed interest rate

- Federal loan forgiveness – if you work in the public sector and borrowed under the Federal Family Educational Loans, you may become eligible for the Public Service Loan Forgiveness Program after consolidating your federal loans

Disadvantages of consolidating your student loans

- More payments, more interest – the flip side of lowering your monthly payments by extending the period of your repayment is that over time, you will make more payments and pay more in interest rates compared to a shorter loan duration

- Income-driven repayment credit could be lost – if you’re on an income-driven repayment plan, loan consolidation may lead to you losing any credit you previously had for payments made on your plan

- Interest rate accrual – if you have any outstanding interest on your loans before consolidating, that could carry over as a part of the principal balance on your new consolidated loan

- Loss of borrower benefits – you might currently have benefits like interest rate discounts or eligibility for cancellation of some of your loans, but these benefits could be lost depending on the terms of the consolidated loan