M&A vs. organic growth: what is best for your insurance agency?

When it comes to expanding your agency, there are two paths to follow – organic growth or mergers and acquisitions (M&A). Both have the power to move your agency to the next level, but which approach is right for your business? Often a mix of both is appropriate. To determine if organic growth or M&A is best, you must assess your goals, priorities, and capacity.

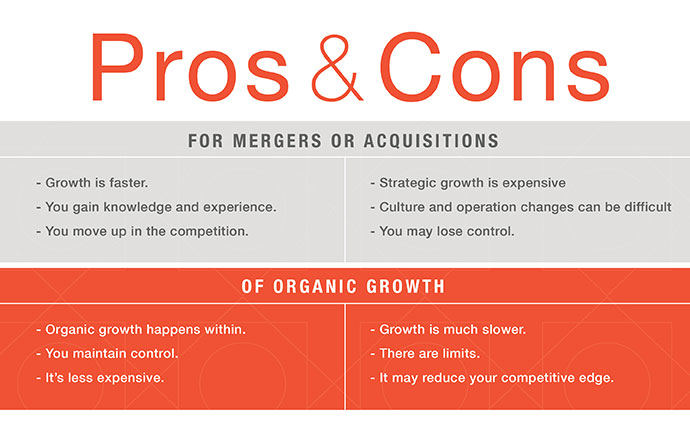

Pros & cons of organic growth

Organic growth is a strategy focused on writing new business. You control the areas to focus on, tactics to get more production out of your staff, and perhaps new expansion areas.

- Organic growth happens within. You know your agency inside and out, so you and your team can adapt to internal changes more quickly and easily.

- It’s less expensive. Mergers & acquisitions can be a tough venture – it is often expensive and very competitive. It is much more cost-effective to invest your capital into organic growth.

But organic growth is not without its challenges:

- Slower process. Organic growth takes time, and growth is generally noticeable over a longer period of time.

- There are limits. If going the organic route, your growth can’t surpass the capacity of your team and resources.

- It may reduce your competitive edge. Growing faster than your competitors keeps you ahead, and the slower pace of organic growth may benefit competitors.

Pros & cons of growth via mergers & acquisitions

M&A is an external approach to improve output and performance by acquiring a new book of business, along with talent, markets, technology, and other capabilities. This approach has its own advantages:

- Faster. The benefits of M&A are almost immediate, including an increase in market share, earnings, and clientele.

- Knowledge and experience advancement. Combining your agency with another comes with the added benefit of their expertise.

- Competitive advantage. Your increased market share and resources will move you ahead of your competitors.

However, there are obstacles to consider:

- Costly. M&A has a significant upfront cost, which may result in your agency accruing debt.

- Complex culture and operational changes. Sudden growth, and integration, requires you and your staff to adapt to new processes and team members.

- You may gain partners. Merging with another agency may mean you bring in new business partners and others to the decision-making table.

The optimal plan for your agency depends on your vision for the future. If your aim is to enter a new market, obtain new technology, or eliminate competition, M&A might be the path for you; if you have the capital to invest. If your goal is to improve performance or reduce costs, organic growth allows you to focus your resources internally.

Whatever path you choose, our agency banking team at Westfield Bank is ready to guide you on your new venture. Let’s get started together.