What business owners need to know about the new beneficial ownership rules

New beneficial ownership rules mandated by the Corporate Transparency Act (CTA) took effect on Jan. 1, 2024, and require certain business owners to report beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury to be stored in a private database. Passed by Congress in 2021, this federal law was designed to protect the U.S. financial system from threats including money laundering, tax fraud, and other illegal financial activities.

Failure to comply with this new federal law does come with strict penalties, so it’s important for business owners to know the latest regulations, obligations, and who to contact for guidance on how to comply. Here is an overview of the key pieces of information you need to know about the CTA.

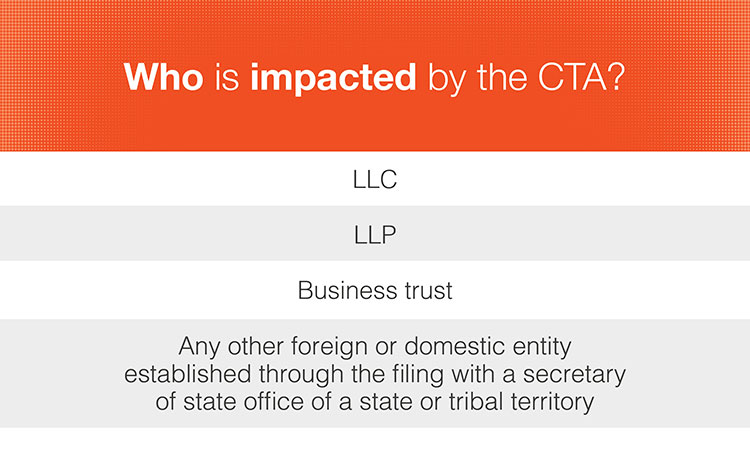

Who is impacted?

You are required to report if your company is categorized as one of the following:

- LLC

- LLP

- Business trust

- Any other foreign or domestic entity established through the filing with a secretary of state office of a state or tribal territory

In other words, if you own a business entity that is registered to do business in the U.S., these new beneficial ownership rules likely apply to you.

Who is exempt?

At the current release of this article there are 23 types of entities that are excluded from the CTA. FinCEN offers a BOI small business compliance guide that may help determine whether your company meets an exemption. Some exempt entities to highlight include:

- Large operating company with 20+ employees and more than $5MM in gross receipts on previous taxable year

- Tax-exempt entities, including 501©(3) nonprofits

- Insurance companies and state-licensed insurance producers

- Banks, credit unions, depository institution holding company, broker or dealer in securities

- Investment company or investment adviser

- Inactive entities

What do you need to report?

If you are the owner of one of the above business types – defined as someone who has “substantial control” over the company or controls at least 25% of the ownership interests of the company – then you are required to report the following BOI (for each business you own) to FinCEN:

- The legal name of your company

- The trade name of your company

- The address and principal place of your company

- The jurisdiction of formation of your company

- The IRS taxpayer identification number and employer identification number (EIN) of your company

Additionally, you’re required to provide the following information regarding you and any other owners of your company:

- Full legal name

- Date of birth

- Current residential address

- Image and details from U.S. Passport, state driver's license, identification document issued by a state, local government, or tribe, or foreign passport (if previous not applicable)

When do you need to report ownership information to FinCEN?

These new rules took effect on Jan. 1, 2024, and existing reporting companies formed before Jan. 1, 2024 are required to report within one year from the effective date, on Jan. 1, 2025. If your company was created after Jan. 1, 2024, you have 90 days from the date of your business’s formation. If there is a change to any of the BOI that you have reported, you have 30 days to submit an update.

How do you report to FinCEN?

BOI can be reported through the FinCEN’s website at www.fincen.gov/boi.

What are the penalties for failing to comply with the CTA?

Companies that are required to report under the CTA that fail to comply may be subject to strict penalties. Penalties may include civil and criminal penalties for willful violations, including fines of $500 a day and up to $10,000 and imprisonment for up to two years. Civil and criminal penalties may be imposed for unauthorized disclosure and use of beneficial ownership information.

Next steps and guidance

With many of our customers likely to be impacted by this act, we recommend working closely with your attorney regarding any questions or concerns you have on reporting under the CTA. If you’re in need of an attorney to help you navigate through these requirements, a community bank like ours creates value by serving as a common thread, connecting our network of customers, business leaders, and centers of influence.