The threat of credit card skimming

Think of all the places you’ve swiped, tapped, or inserted your credit or debit card lately. At the grocery store, gas pump, ATM, or any other in-person transaction you’ve completed, there’s a chance you’ve been exposed to the threat of credit card skimming. Also known as credit card overlay, skimming is a type of financial crime in which your card information is stolen from a payment terminal.

How does skimming work?

Unfortunately, credit card skimming can be hard to spot. Criminals have found ways to place overlay skimmers on top of a card reader, designed in a way that it looks like a legitimate part of the transaction device. In other cases, internal skimmers are placed inside of a card reader, making it difficult to notice. These skimmers read the magnetic strip on your card when you swipe or insert it, pulling sensitive information including your name, card number, expiration date, PIN, and the security code.

In more advanced cases, skimmers can’t be seen at all. Wireless skimmers using Bluetooth technology can obtain credit card information during a transaction, and sometimes small cameras are hidden in the view of the keypad.

Staying vigilant

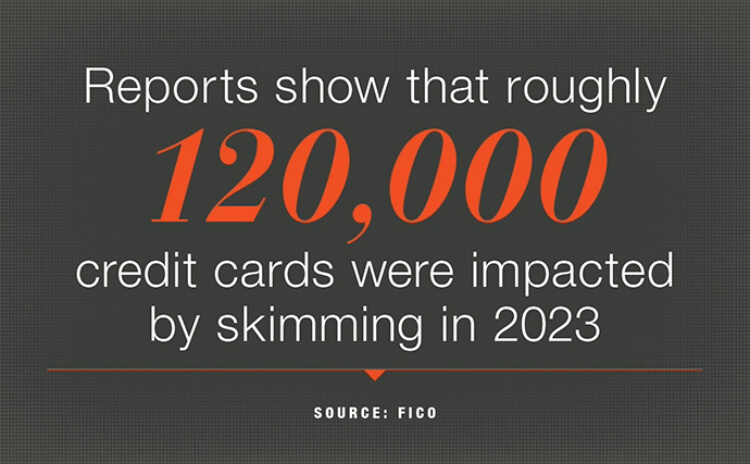

In the U.S., skimming has been on the rise in recent years. According to FICO, roughly 120,000 credit cards were impacted by skimming in 2023, compared to 70,000 the previous year. As a consumer, this doesn’t mean you need to panic about every purchase you make. Instead, it’s an important reminder to maintain informed awareness around this issue.

While skimmers are designed to be hard or impossible to spot, sometimes there are warning signs you can identify. If the card reader looks like it was messed with in any way, appears out of place, or looks out of alignment, these could be red flags. If there is anything suspicious at the point of sale, consider not making the purchase, paying in cash, or using a different card reader if available. Consider letting a store employee know, as this could help protect other customers from a potential scam.

Furthermore, it’s a good habit in general to cover the keypad with your hand when you’re completing a transaction. If a hidden camera is being used, simply obstructing the view can prevent a scammer from obtaining your PIN and thus curtailing their ability to access and use your card.

If you have the option, it’s usually best to use your credit card in these situations as most credit cards have more fraud protections in place. Plus, in the event of a credit card scam, you’re not immediately out the money like you would be with a breached debit card.

All of this underscores the ever-importance of checking your credit and debit card accounts regularly. The sooner you spot suspicious or unauthorized activity, the greater chance you’ll have to prevent any personal financial losses.

Financial institutions have an important role to play in protecting consumers from various types of fraud, including skimming. That’s why Westfield Bank provides debit card holders with tools and resources designed to help prevent and report fraud.