What FDIC insurance means for your business

When you hear or read that a bank is “Member FDIC,” you can be assured that your deposits are safe with that bank. In fact, since the founding of the Federal Deposit Insurance Corporation in 1933, no individual or business has lost even a penny on an FDIC-insured deposit. (For a bit of history on the FDIC, check out our article: What is the FDIC?)

FDIC coverage is typically thought to be for consumer protection. But nearly a century after Congress created this independent agency, the FDIC designation remains critically important for both consumers and businesses who are concerned about worst-case scenarios that may impact their personal or company funds.

As a business owner, what do you need to know about the types of coverage, limitations, and requirements put forth by the FDIC?

What’s covered by the FDIC?

The FDIC is designed to cover deposits in traditional banking accounts, such as business savings, checking, certificate of deposit (CD), and money market accounts in FDIC-insured banks. The FDIC does not cover investment and securities products, including but not limited to, stocks, bonds, mutual funds, or crypto assets. If you’re ever unsure if a deposit is covered, you can easily double check with your bank.

What are the FDIC limits?

You’ve probably heard that the FDIC insures deposits up to $250,000. For businesses all deposits owned by a corporation, partnership, or unincorporated association (non-profit or for-profit organizations), at the same bank, are added together and insured up to $250,000. This is separate from your personal accounts. So, what happens if your company has more than this limit on deposit?

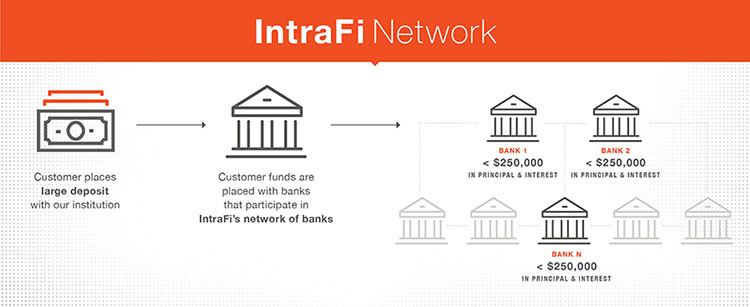

A common strategy for protecting business deposits greater than $250,000 is by leveraging IntraFi® Network Deposits℠. This solution, offered by Westfield Bank, allows multi-million-dollar deposits to be insured by tapping into a network of FDIC-insured financial institutions. If your organization chooses this service, the technology allows us to divide your large deposit into smaller amounts under the $250,000 limit and deposit them among the network of FDIC-insured banks - saving you the hassle of having to manage accounts with several banks.

What else can the FDIC do for business owners?

In addition to providing important insurance on business deposits, the FDIC has extensive educational resources designed for new and existing small business owners. Check out the FDIC’s Money Smart for Small Business page to access informational and training materials related to a range of relevant business topics.

The peace of mind you deserve

Westfield Bank is proud to be FDIC-insured, as this designation is a testament to the financial safety and security we provide our business customers of all sizes. Our business banking team is here to work with you to provide personalized solutions for your company, empowering you to run your businesses with the peace of mind you deserve.